Decentralised Exchange

Introduction

Year 2038. FIAT currencies have collapsed under nations' huge public debts, and a great reset in the economy has favorised the raise of City Coins: each main city is now emitting its own token for citizens and tourists to pay for public services (transport, museums, ...) and some affiliated retail shops.

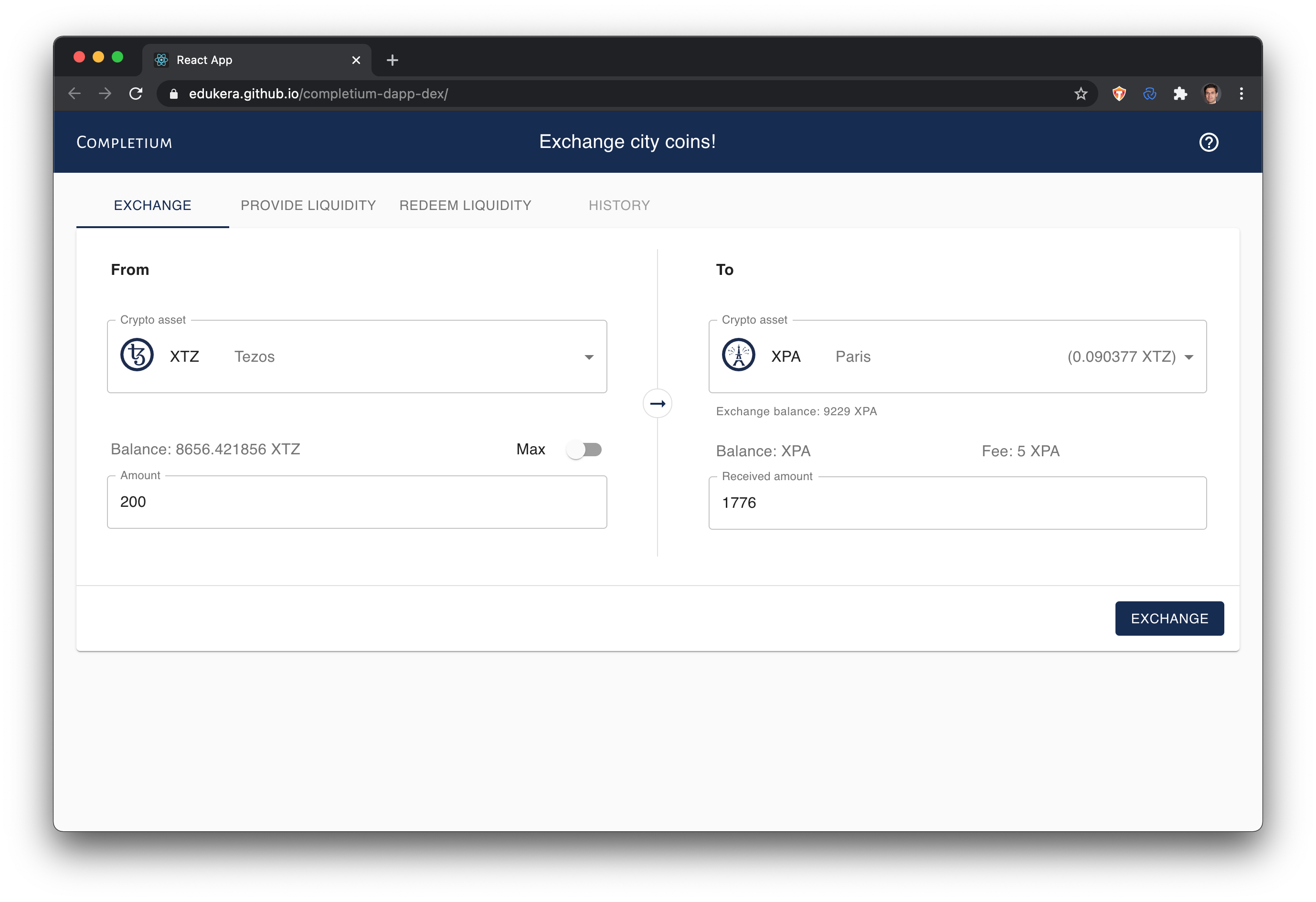

When moving or traveling from one city to another, you need to exchange from one City Token to another.

Nine prestigious cities have decided to get together and propose a Decentralized EXchange (DEX) system on the Tezos blockchain: Athens, London, New York, Moscow, Paris, Rio de Janeiro, Rome, Tokyo and Sydney.

Buy and sell City Tokens with the DEX!

DApp

Exchange principle

A Decentralized Exchange (DEX) is a business that allows customers to trade cryptocurrencies or digital currencies for other assets in a decentralized way, that is without the need for an intermediary.

The automated market maker's (AMM) principle of the DEX presented in this example DApp is the one of Uniswap, as presented in this paper.

There is a pool for each each token from which tokens are withdrawn from and credited to. The quantity of tokens in the pool is noted p.

Say a user wants to exchange a quantity qA of Token A against a quantity qB of token B. In that case, the user credits the pool of Token A with qA tokens, and qB tokens from pool of Token B are sent to the user, as illustrated below:

How to compute qB as a function of qA?

The principle is to consider that the product of pA and pB is constant; it is named constant product markets. Formally there exists a constant value k such that:

The quantities qB of Token B and qA of Token A are such that they keep the resulting pool quantities equal to this constant, which writes:

Each exchange transaction is subject to a fee. Let f be the percentage of qA that are subject to a fee, so that

is the quantity left to increment the pool. The constant product market equation then writes:Which simplifies to:

At the beginning, pools A and B are empty and must then be initialized by providing liquidity to both of them, thus setting the initial exchange rate.

It is also possible to provide liquidity to the pair of of pool any time according to exchange rate. Transaction fees are transferred to liquidity providers in proportion to their liquidity ownership.

Architecture

The section above presents the exchange principle between two tokens A and B. In the example DApp you can exchange between XTZ and the City Coins: each city coin's pool is associated to a dedicated XTZ (Tezos currency) pool:

Tokens ownership is managed with a FA 1.2 smart contract per Token. FA 1.2 is a specification of Fungible Token ownership for the Tezos blockchain; a FA 1.2 contract provides the following entry points:

allowto authorize a third party to transfer a given quantity of tokentransferto transfer a quantity of tokens from one account to another according to transfer authorizationsget_balanceenable to retrieve account balance

A detailed presentation of the Archetype implementation is available here.

The DEX smart contract manages the XTZ pools, the interactions to the FA 1.2 contracts, and the liquidity ownership data:

exchangeis the unique entry point to exchange- from XTZ to a token

- from a token to XTZ

- from a token to another token

provide liquidityto provide liquidity the XTZ pool and the token pool against liquidity tokensredeem liquidityto redeem liquidity tokens for XTZ

When exchanging from one city token A to another B, the DEX actually generates two exchanges:

- exchange from A to XTZ

- exchange from XTZ to B

Note that:

- when exchanging city token for XTZ, the token ownership is transferred from the user's account to the DEX account as a FA 1.2 does not allow token destruction; in that case the user needs to allow the DEX for transferring ownership by calling ``

- when exchanging XTZ for city token, the token ownership is transferred from the DEX's account to the user's account

Inspect the DEX smart contract transactions in Better Call Dev: